MUMBAI: Markets regulator Sebi is proposing to overhaul the SME (small & medium enterprises) IPO process through some drastic changes that aim to make the segment safer for investors, increase compliance requirement on companies and also increase the cost these entities to remain listed.

Among several proposals in a consultation paper, select ones deal with increasing the minimum SME IPO size to Rs 10 crore (currently, there is no minimum requirement), up to a four-fold hike in IPO application size to Rs 4 lakh, limiting offer for sale by promoters to 20% of the issue size and also setting up a compliance monitoring agency for SMEs that went public to keep a tab on the utilisation of the money taken from investors.

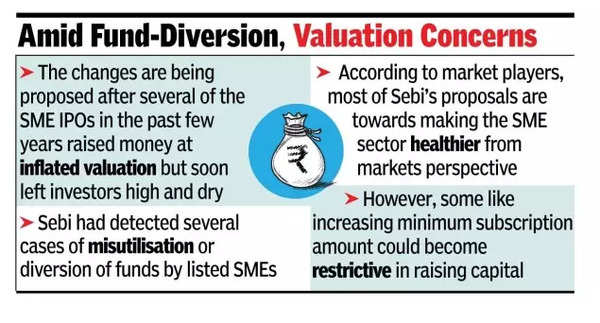

The changes are being proposed after several of the SME IPOs in the past few years raised money at inflated valuation but soon left investors high and dry. Sebi had detected several cases of misutilisation or diversion of funds by listed SMEs. Some of these companies were also penalised by the regulator.

“The retail individual participation has increased in the SME IPO over the last few years. Therefore, considering that SME IPOs tend to have higher element of risks and investors getting stuck if sentiments change post listing, in order to protect the interest of smaller retail investors, it is proposed that the minimum application size in SME IPOs to be increased from Rs 1 lakh to Rs 2 lakh,” Sebi said in its consultation paper. Sebi also proposed to make IPO offer documents of SMEs public for at least 21 days. Currently such offer documents are submitted to the exchange on which the company plans to list, vetted by the bourse and are made public closer to the date of open of the IPO.

Sebi is also proposing to have a minimum Rs 3 crore operating profit in two out of three years before the IPO papers are filed. Currently, there is no such requirement. The regulator also proposed that an IPO where the primary objective is to payment of loans taken from the promoter or promoter group, such issues should not be allowed. Sebi also proposed that listed SMEs should, like other larger listed ones, should also disclose their shareholding, results, etc, on a quarterly basis.

According to Vineet Arora, MD, NAV Capital, a Dubai-based wealth management advisory firm, most of Sebi’s proposals are towards making the SME sector healthier from markets perspective. However, some like increasing minimum subscription amount could become restrictive in raising capital and wider participation. “As opposed to this, we would recommend tightening of disclosure requirements for SMEs, quarterly reporting of financials and monitoring of market makers.” Sebi has sought public comments on the proposals till December 4.